As online shopping becomes more prevalent, businesses continually search for ways to enhance their customers’ purchasing experience. Companies are accomplishing this by offering “buy now, pay later” (BNPL) payment options.

These payment options allow consumers to buy goods and make payments in installments instead of paying for everything upfront. This is where Apple Pay Later comes in. Apple Pay Later is a recently launched BNPL service that allows eligible iPhone users to make purchases and pay for them over time.

The Importance of Offering a BNPL Payment Option:

BNPL payment options are quickly becoming a popular feature for retailers. This is because they offer consumers increased flexibility and control over their purchases. Essentially, BNPL options allow people to make purchases even when they cannot afford to pay for them upfront.

They also make budgeting easier by splitting the purchase cost into multiple payments. For businesses, these options increase sales while making it more accessible for customers to purchase their products. Apple Pay Later aims to offer a unique BNPL option with its own set of features.

Apple Pay Later’s features:

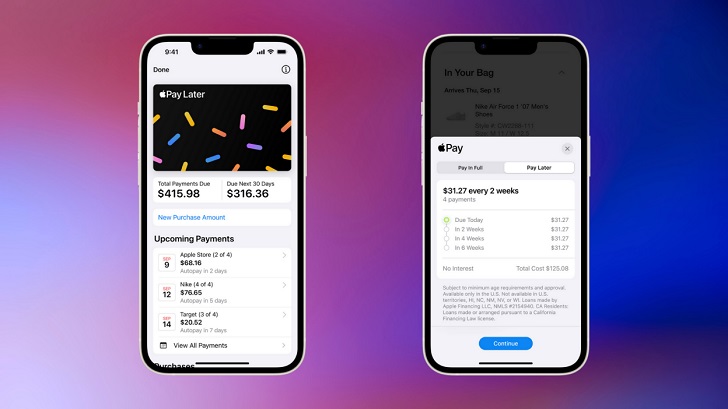

Apple Pay Later allows eligible users to split the cost of their purchases into four interest-free payments, paid bi-weekly. Apple Pay Later also offers automatic and additional payment options, allowing users to pay earlier than scheduled or make additional payments.

Apple Pay Later requires a credit check and has a purchase limit that varies depending on the user’s creditworthiness and purchase history.

How Does Apple Pay Later Work?

The transaction process for users of Apple Pay Later is relatively straightforward. Users can choose Apple Pay Later as a payment option from an eligible merchant app or website during checkout. Once selected, the user chooses the payment plan that suits them best, with payments spread over six weeks.

The user then provides their Social Security number for a credit check, and the purchase is approved upon approval. The process for merchants differs slightly, with payment processing primarily handled through Goldman Sachs, Apple’s partner for this service.

Advantages of Using Apple Pay Later:

One of the most significant advantages of using Apple Pay Later is the interest-free aspect of the service. Additionally, users can choose which payment plan suits them best, depending on their financial situation.

The service is also fully integrated with the Apple Wallet, making it seamless to use. Automatic and additional payments allow users to pay their balances off faster and reduce the interest they might pay over time.

Limitations and Considerations:

An important thing to consider before using Apple Pay Later is that the service may negatively affect the user’s credit score. Defaulting on payments or failing to make payments on time can hurt the user’s credit score.

Additionally, Apple Pay Later requires a debit card payment method, meaning users cannot use a credit card to make payments. Finally, the purchase limit for Apple Pay Later varies, so users may have multiple instances of being approved for use.

Apple Pay Later Subscription:

The feature’s payment plans start with a minimum payment of $35 or 25% of the purchase price (whichever is greater). The payment period lasts six weeks, with payments due every two weeks.

Automatic payments can be set up to pay off the balance as soon as the stated payment period ends, and additional payments can also be made at any time throughout the process. Credit checks are conducted through Goldman Sachs and determine the service’s eligibility and the maximum purchase limit.

Comparison With Similar Services:

Apple Pay Later’s most prominent competitors include PayPal Pay in 4 and Sezzle. Both offer similar BNPL features, such as automatic payments, payment plans, and no interest. However, these services have some differences, including flexibility of payment plans, purchase limits, and the payment method required.

How to Access Apple Pay Later:

Apple Pay Later is available to users with an eligible iPhone running iOS 15 or later in the United States. Apple is currently working on expanding the service to more users and merchants. Users must provide their Social Security number and a valid debit card to access Apple Pay Later.